Sensitivity Analysis for Mineral Processing Projects

By Jorge L. Lerena

The Economic Feasibility or “Economic Attractiveness” of a Project is determined by economic indicators such as the Project’s Payback Time, Internal Rate of Return (IRR), or Net Present Value (NPV).

These indicators are the result of an Economic Analysis which was based on estimated Project Capital Expenditures (CAPEX), Operating Expenditures (OPEX), and Market Price among other variables.

This brings the following questions:

- How is the Project’s Economic Attractiveness affected by variations in the Project’s CAPEX or OPEX?

- Under which scenarios is the project not economically attractive?

- Which are the key factors to keep track during the project development?

The following Case Study is used to demonstrate a project’s susceptibility to input variables:

- Project: Greenfield Cement Plant (X, tons per year capacity, Y USD/ t Market Price).

- Project Stage: Prefeasibility Study.

- Project CAPEX: USD 450 Million.

- Project OPEX: USD 53 / ton of Cement.

For the above scenario, the Economic Model would show the following financial indicators which present the project as economically attractive:

- Pay Simple Back: 6 years.

- Project Stage: Prefeasibility Study.

- Project IRR: 16%.

- Project NPV: USD 177 Million.

In another scenario, what happens if the Project CAPEX exceeds the budget by 20% and the estimated OPEX Cost is underestimated by 15%? Is the project still attractive?

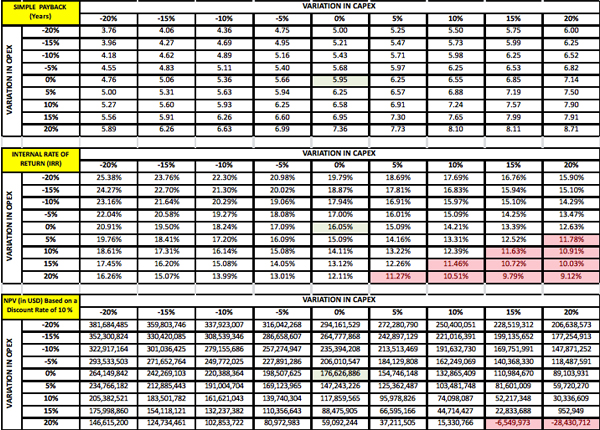

The following analysis shows the sensitivity of Payback Time, IRR and NPV based on variations of + 20% in the Project’s estimated CAPEX and/or OPEX.

Table 1. Sensitivity of Payback Time, IRR, and NPV

Note. Based on variations of + 20% in the Project’s estimated CAPEX and/or OPEX.

From the above, it can be easily seen how variations in OPEX and CAPEX affect project economic indicators.

This Sensitivity Analysis can also be generated for other variables such as price, interest rate, inflation, and others which may be of concern in a project.

A Sensitivity Analysis can be used to account for other variables, such as:

- Sensitivity of OPEX from fluctuation in fuel costs (or labor, electricity costs, etc.).

- Sensitivity of CAPEX from fluctuation in steel costs (or concrete costs, number of piles, etc.).

- Sensitivity of Payback from fluctuation in annual sales.

A Sensitivity Analysis allows investors to assess risk.

Figure 1. Project Construction

PEC Consulting is experienced in developing Economic & Sensitivity Analysis Models and recommends actions at every stage of Project Development: Conceptual, Prefeasibility, Feasibility, and project execution to minimize risks. Our services include:

- Sensitivity analysis for cement plant projects.

- Sensitivity analysis for lime plants projects.

About the Author(s)

Jorge Lerena

Mr. Lerena has over 15 years of experience in project management and design as well as financial and economic valuation of Cement and Lime Plants. He has internationally proven planning, coordination, negotiation, and managing skills. His expertise also includes the evaluation of limestone reserves and studies for the expansion of Brownfield lime plants and for Greenfield lime plants in South America, including geological evaluations and process selection. Mr. Lerena achieved an Executive MBA from ESEUNE “Escuela Europea de Estudios Universitarios y de Negocios” in Bilbao, Spain. He earned a BS in Industrial and Systems Engineering from the Universidad de Piura, Peru.

PEC Consulting Group LLC | PENTA Engineering Corporation | St. Louis, Missouri, USA

How can we help you? Get in touch with our team of experts.