Qualitative Aspects of Project Risk Management

By Lucia Martinez

Mineral Industry projects are subject to high risk because of their size, complexity, and high cost.

The opportunity to manage risk decreases as the project life cycle progresses. Therefore, it is essential to timely plan and perform effective risk management starting at the onset of the project.

During the feasibility analysis and design stages, a thorough analysis of the different characteristics and project objectives should be carried out for the benefit of all interested parties. The applicability and accuracy of the assumptions made at this stage should be the basis for decision-making by the Stake Holders and must be re-analyzed at later stages of the project. Therefore, it is essential that these assumptions are based on a process of proper risk management.

Furthermore, it is during these early design stages that the project’s viability will be determined. If findings indicate that it may not be possible to comply with technical, financial and other key requirements, the project should be re-analyzed for a different set of conditions or possibly abandoned.

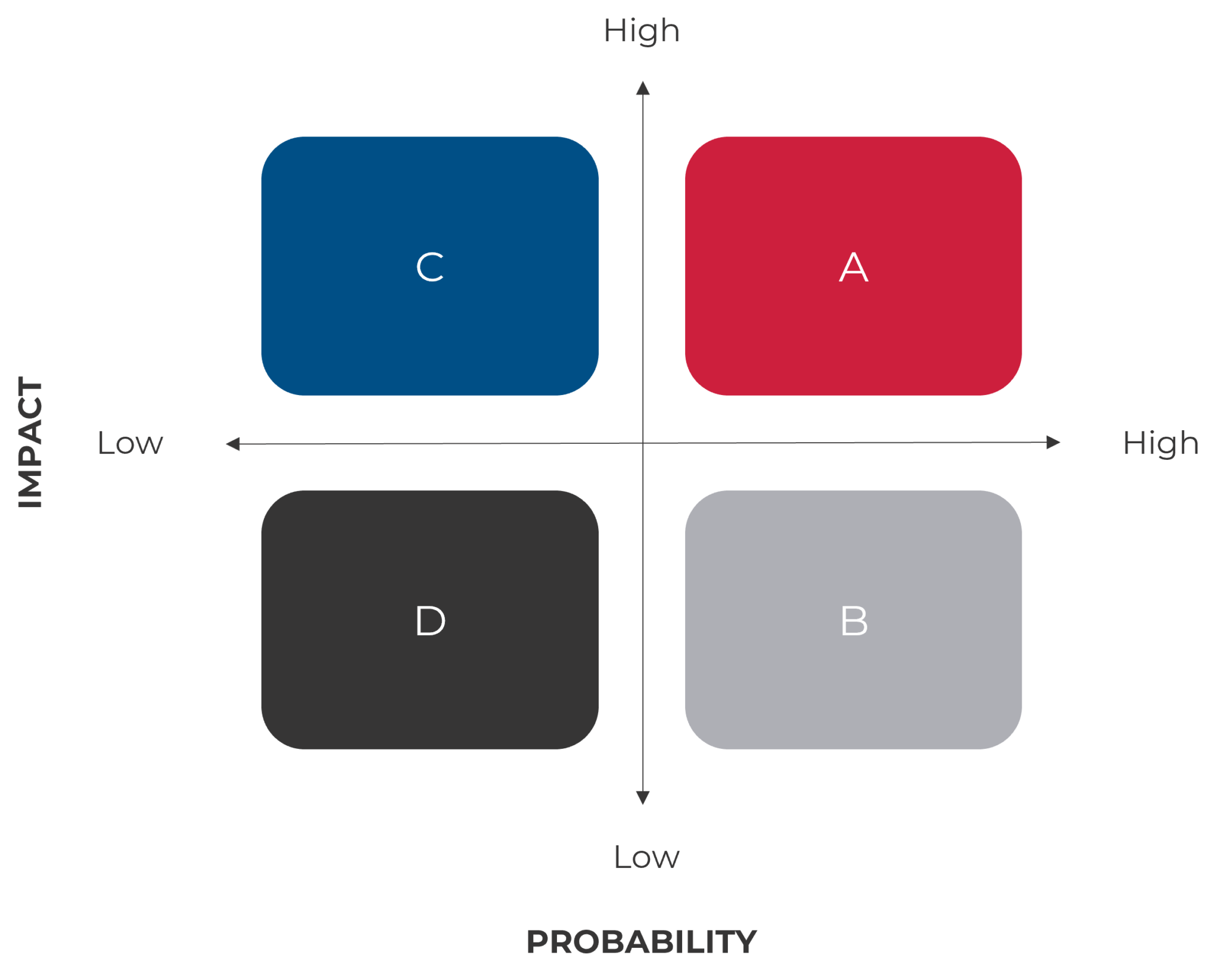

In order to properly evaluate project risks, one must consider both the probability of risk occurrence and the impact on the project objectives once the risk event occurs. This is best achieved by plotting the risks on the ‘probability-impact’ matrix.

Figure 1. Probability-Impact Matrix

In the matrix, the x-axis represents the probability value, while the y-axis represents the impact value.

The matrix consists of four quadrants: A, B, C, and D.

Quadrant A represents the risk with high impact and high probability of occurrence. The project team must implement an action plan to mitigate these risks.

Quadrant B represents the risk with high probability and low impact. These risks are most likely to occur. Thus, risks in quadrant B should be included in the risk mitigation plan.

Risks in Quadrant C have a low probability but will severely affect the project. The typical examples are external risks such as negative environmental impact and changes to laws and regulations that affect the project economics. Furthermore, risks such as design flaws, construction accidents or errors have a high impact on a project’s duration and cost. Certain risks in this quadrant can be managed by insurance.

Risks in Quadrant D have the lowest probability and lowest impact on project failure. These risks are usually ignored.

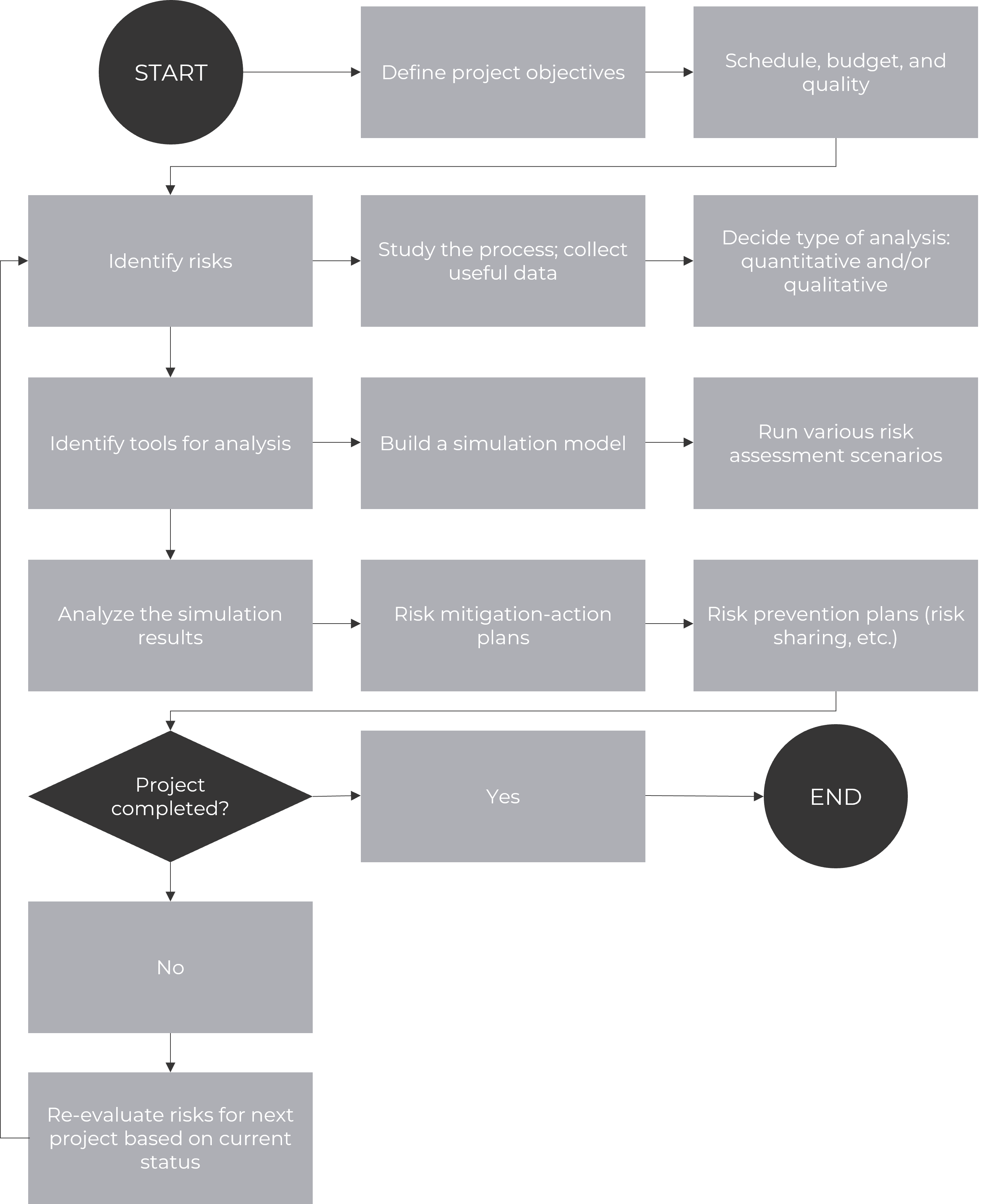

The chart below illustrates the standard path of the process for a Minerals industry project.

Figure 2. Risk Assessment Process Map

Mineral Mining and processing projects are subject to risks of various natures.

Risk factors in order of importance are:

- Raw Materials.

- Market.

- Local Political and Social Conditions.

- Environmental Regulations and Permitting.

- Capital Investment Variations.

- Operating Costs Variations.

- Financing.

- Infrastructure.

- Project Schedule.

Once the project risk factor have been identified, the next step is to identify the specific risks that may result from each of the risk factors.

In a project, Risk is defined as an event or condition that, if it occurs, has a negative effect on project objectives. Negative risks affect project objectives, such as:

- Higher project costs.

- Delays in the Project Schedule.

- Lower Quality.

- Environmental Impact.

- Conflict with Local Communities.

- Loss or Damage to People or Property.

Studying in detail the nature of a risk is a good way to create a risk prevention plan.

1. Raw Materials

In order of importance, the availability and quality of raw materials have the highest level of potential risk (Quadrant A). Without proper available raw materials, the project is condemned to failure. There are guidelines that set the parameters to minimize this risk, such as:

- Drilling Plan. Drilling sampling and testing help verify that there are sufficient minable raw materials to support the project life.

- Chemistry & Physical Properties. Samples of each drill hole are analyzed to verify the quality of raw materials throughout the depth of the mineral resource.

- The Reserves Information and the Mining Plan are very important to prove the economics of exploitation.

2. Market

The market represents an important risk (Quadrant A). A good Market Study should cover:

- Projected Sales volume by product.

- Quality.

- Economic Stability.

- Infrastructure.

- Logistics.

- Economic Framework growth.

- Competition.

3. Political and Social Conditions

The study of these risks should be done by a specialized firm. The risk involved could be very high (Quadrant C).

- Long-term Political stability to allow full ROI.

- History of social unrest.

- Acceptance of mine and plant by neighboring communities.

- Effect of road traffic on local population.

- Investment that may be necessary to mitigate risk.

4. Environmental Regulations and Permitting

One of the major causes of project delays is in obtaining governmental permits. In fact, many projects never materialize due to permitting issues (Quadrant C).

It is very critical therefore to do a thorough due diligence on the regulations applying to the project property during the early stages of project development. For this purpose, either the Owner or the Consulting firm responsible for the Feasibility Study should retain an environmental consulting firm who is familiar with both the local regulations and the agencies responsible for issuing the permits. In most cases, environmental permits are tied to local social issues, so combining the environmental and social due diligence is advisable.

5. Capital Investment

The economics of a project are highly dependent on the total capital cost estimate (Quadrant C). The investment cost in turn is dependent on many factors which must be carefully controlled and monitored. A well-prepared and comprehensive Feasibility Study carried out by a specialized competent firm is the key to an accurate estimate on which the Board of Directors can rely when approving the budget for the project.

The following are key factors for a good estimate:

- A detailed scope of all the components that make up the project

- Price quotes from equipment suppliers

- Budgetary quotes from construction contractors

- Sufficient engineering to do a thorough capital cost estimate

- A project management program with strict budget and schedule controls to complete the project on budget and on-time.

6. Operating Costs

The basic cash flow of a project is the product sales minus the operating costs (OPEX) and taxes. Making an accurate OpEx estimate is therefore critical to assessing the success of a project (Quadrant D).

Critical OpEx factors are:

- Labor

- Fuel

- Electric Power

- Consumables

- Maintenance

- Supply Chain Logistics

- Logistics of product to supply the market

- A competent firm with a high level of industry experience can make a good OpEx estimate for a site specific project.

7. Financing

Is the project financeable, and on what terms? Very few projects can be executed without financing; therefore, this is one project aspects that must be investigated from the very conceptual stages of project development.

Financing organizations will do their own due diligence of projects which will require significant financing values. A well prepared and thorough Feasibility Study will facilitate the financing organizations due diligence and expedite the financing process.

If the project economics are attractive the risk factor will fall in Quadrant D. But if the location of the project lacks political or social stability, then the risk factor will fall in Quadrant A.

8. Infrastructure

The lack of proper infrastructure will imply costs which may be significant in relation to the capital investment of the mineral processing facility (Quadrant C).

Availability and reliability of the following must be considered:

- Electric Power.

- Water Supply.

- Logistics/accessibility for the supply of consumables and product dispatch.

9. Project Schedule

A risk that is always present in every project is delays caused by unforeseeable events, such as the delays of a permit to start building or in the delivery of materials which prevent starting an activity.

The delay may have a high probability occurrence, but a low impact on the project failure (Quadrant B).

It is important that in the early stages the project management design a realistic schedule for the project that should be continuously updated in order to avoid delays as much as possible.

About the Author(s)

Lucia Martinez

Mrs. Martinez is part of the team that executes due diligence and valuation projects for the cement and lime industries. Her excellent analytical skills come into play when doing market research for projects. She also provides assistance with document control and business development activities, having been responsible for the selection & implementation of databases for company use. She is proficient in AutoCAD, MicroStation, and MS Office. Mrs. Martinez holds a BS in Industrial-Technical Engineering and a major in Mechanical Engineering Technology at Jaime I University, Castellón de la Plana, Spain.

PEC Consulting Group LLC | PENTA Engineering Corporation | St. Louis, Missouri, USA

How can we help you? Get in touch with our team of experts.