The Optimal Capital Structure for Financing an Industrial Project

By Antonio J. Benavides

When determining the best course of action to finance a new industrial project, two key factors should be analyzed in depth with respect to the unique characteristics and objectives of the investment:

-

- The optimal mix of available sources of debt and equity finance.

- The investment vehicle: Whether to structure the investment within the owner (project sponsor) firm’s balance sheet, or rather to set up a special purpose vehicle (SPV) involving a non-recourse or limited recourse financial structure.

1. Determining the Optimal Mix of Available Sources of Debt and Equity Finance

Assumptions about the costs of equity and debt, overall and for individual projects, profoundly affect both the type and the value of the investment made by the sponsoring firm. Expectations about returns determine in which projects managers will invest and also its effects on the overall company’s financial performance.

The optimal capital structure of a firm is the best mix of debt and equity financing that maximizes a company’s market value while minimizing its cost of capital. In theory, debt financing offers the lowest cost of capital due to its tax deductibility. However, too much debt increases the financial risk to shareholders and the return on equity that they require. Thus, companies have to find the optimal point at which the marginal benefit of debt equals the marginal cost.

The optimal financing mix will minimize the weighted average cost of capital (WACC) and match the assets being financed, taking into consideration the specific risks of the target investment, thereby optimizing the net present value (NPV) of the investment.

Refer to Figure 1 where Kd is the cost of debt and Ke is the cost of equity.

Figure 1. Capital Structure

In order to determine the optimal financing mix, it is necessary to determine the default spread attributable to the project. For projects undertaken by firms with a debt rating the corresponding spread can be directly determined. If no debt rating is available, a synthetic rating and corresponding spread can be determined from the interest coverage ratio. Adding that number to a risk-free rate should yield the pre-tax cost of borrowing for the firm to finance a new investment.

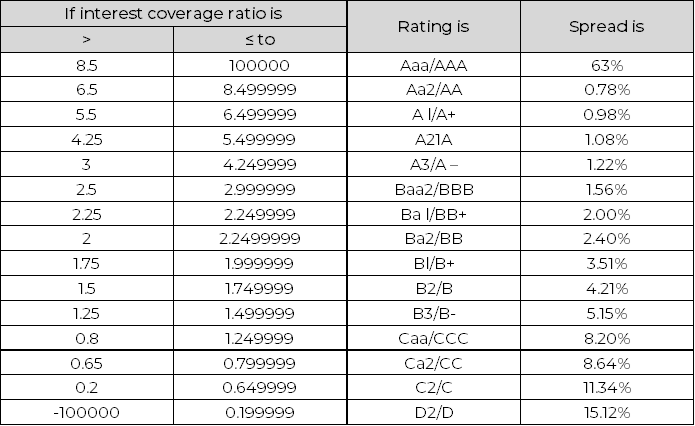

Table 1 illustrates synthetic ratings and corresponding spreads for different values of the interest coverage ratio (developed market firms with market cap > $5 billion).

Table 1. For Developed Market Firms With market cap > $5 billion

Note. Adapted from Damodaran (2020).

The operating income that should be used to identify the interest coverage ratio and thereby determine the default spread and optimal debt ratio is a “normalized” operating income (the operating income is the income that this firm would make in a normal year). Specifically:

-

- For a cyclical firm, this may mean using the average operating income over an economic cycle rather than the latest year’s income

- For a firm which has had an exceptionally bad or good year (due to some firm-specific event), this may mean using industry average returns on capital

- One-time charges or profits should not be considered

Additional firm and sector specific factors may also influence the optimal debt ratio:

-

- Higher tax rates / pre-tax returns imply a higher optimal debt ratio (due to tax benefits).

- Higher earnings volatility / default spreads imply a lower optimal debt ratio (due to insolvency risks).

2. Off Balance Sheet Project Finance: Non-Recourse or Limited Recourse Financial Structures

Long-term infrastructure / industrial projects can often be financed using a non-recourse or limited recourse financial structure.

Project financing is a loan structure that relies primarily on the project’s cash flow for repayment to debt and equity holders, with the project’s assets, rights, and interests held as secondary collateral.

Project finance is especially attractive to the private sector because companies can fund major projects off-balance sheet. Project finance through special purpose vehicles (SPVs) are especially frequent in Build-Operate Transfer (BOT) projects for example. The entity’s sole activity is carrying out the project by subcontracting most aspects through construction and operations contracts. Since there is no revenue stream during the construction phase of new-build projects, debt service only occurs during the operations phase, therefore generating significant risks for the financing parties during the construction phase.

Since the project remains off-balance sheet, there is limited or no recourse to the project’s sponsors. To preempt deficiency balances, loan-to-value (LTV) ratios are usually limited to 60% in nonrecourse loans, and lenders impose higher credit standards on borrowers to minimize the chance of default. Non-recourse loans, on account of their greater risk, carry higher interest rates than recourse loans

3. Conclusions

In conclusion, determining the optimal mix of available debt and equity sources of finance as well as the optimal vehicle through which to structure the investment are critical decision factors that can significantly improve the economic returns and feasibility of the project, and therefore facilitate capturing the required financing from third parties to make the new undertaking a reality.

At PEC Consulting Group we work with each of our customers to adapt a tailored approach to determine and help structure the best financing solution for new industrial projects, determined by the specific characteristics and objectives laid forth.

About the Author(s)

Antonio J. Benavides

Mr. Benavides has over 20 years of experience in banking, consulting, project management, digital transformation, and financial risk management. His expertise includes managing all aspects of consulting projects, from design and planning to execution and reporting. His extensive financial services experience includes financial analysis, integration management, operational & sales transformation and organizational development. He has managed projects throughout the US, Europe and Latin America. Mr. Benavides is a Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), and has an MBA from IESE Business School in Barcelona, Spain.

PEC Consulting Group LLC | PENTA Engineering Corporation | St. Louis, Missouri, USA

How can we help you? Get in touch with our team of experts.